The US Government Is Paying Some Eye-Popping Interest On Its Massive Debt

It's gotten a lot worse in the era of elevated rates. Giphy

Giphy

News that is entertaining to read

Subscribe for free to get more stories like this directly to your inboxFor ordinary working-class Americans, receiving $2 million would be a life-changing windfall. But that’s how much the federal government paid every 60 seconds last month just to maintain the interest on its debt!

And with interest rates remaining high, we can only expect these staggering interest payments to continue.

How we got here

There’s plenty of blame to go around, but the fact is that the U.S. government is currently in debt to the tune of $34 trillion. That’s an absurdly high number that is constantly accruing interest.

In March, the Treasury Department paid $89 billion in interest alone, which did nothing to reduce the overall debt. Essentially, all the taxes you and everyone you know will ever pay in your entire lives won’t put a dent in the amount it takes just to make interest payments on the debt for even a few minutes.

Annual interest payments are expected to top $1 trillion this year for the first time, representing a sum nearly twice as high as before central bankers raised rates in response to inflation.

Where we go next

In many ways, the damage seems to already be done. Arguments can be made about how the government can cut spending and/or raise taxes, but this whopping debt load isn’t going anywhere.

And while investors in the bond market are benefiting from the 10-year Treasury yields that have risen alongside interest rates, most of the country is anxious for rate cuts. Although it seems counterintuitive, JPMorgan strategist Jack Manley says lowering rates could help bring consumer costs down.

“You’re not going to see meaningful downward pressure on inflation until you see meaningful downward pressure on shelter costs,” he said. “And you’re not going to see meaningful downward pressure on shelter costs until the Fed lowers interest rates.”

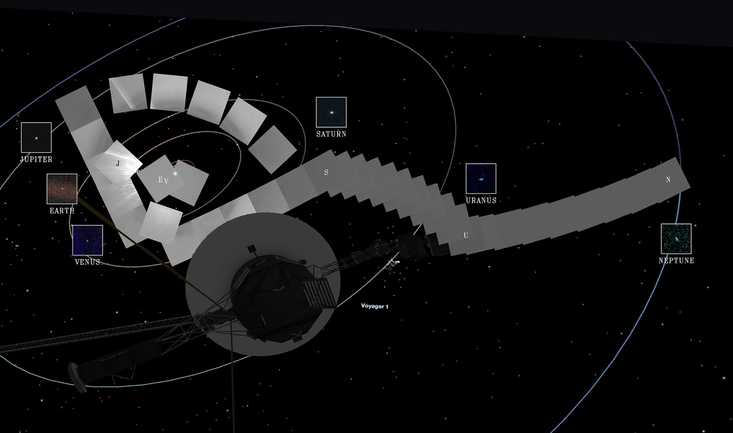

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned.

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned. One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right."

One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right." Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.

Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.